RELIABLE CAPITAL FOR THE RESIDENTIAL ECOSYSTEM

PLATFORM

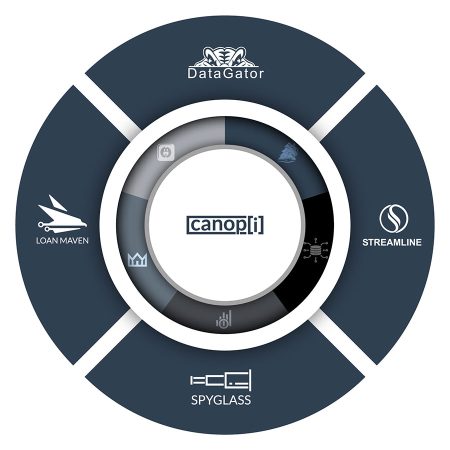

All Roads Lead to Churchill

LENDER FINANCE

RESIDENTIAL TRANSITION LOAN

INSTITUTIONAL PROPERTY LOAN

Play Video

RECENTLY CLOSED FINANCING FACILITIES

Facility Size

$500MM

Target Assets Multifamily | Construction

Date Closed Sep-23

Global real estate investment, operating and development company with more than $73.8 billion in assets under management across Canada, the US, the UK, Europe and the Asia Pacific.

Facility Size

$500MM

Target Assets Residential / Multifamily | Construction & Bridge

Date Closed Aug-23

Tech-enabled private lender of business purpose new construction, residential bridge, and multifamily bridge loans in the US. Since inception in 2009, the firm has originated $8.0 billion in total loan volume.

Facility Size

$500MM

Target Assets Residential / Multifamily | Construction & Bridge

Date Closed Aug-23

JV between leading global investment management firm and mortgage originator that was established in 2023 to leverage the capabilities of both firms to originate residential and multifamily bridge and construction loans.

Facility Size

$500MM

Target Assets Residential / Multifamily | Construction & Bridge

Date Closed Aug-23

Tech-enabled whole loan aggregator that is supported by capital commitments from a global P.E. firm. Platform focuses on business purpose residential, multifamily bridge loans, and rental investor loans.

Facility Size

$250MM

Target Assets Residential / Multifamily | Bridge

Date Closed Jul-23

JV between global alternative investment manager and mortgage lending platform, established to originate predominantly single family and 2-4 unit multifamily bridge loans.

Facility Size

$400MM

Target Assets Multifamily | Construction & Bridge

Date Closed Jun-23

NYC-based private real estate lender specializing in bridge and construction financing for the middle market. Firm has executed over $3.5 billion in financing across 500 loans since inception in 2013.